Everything you need to know about Budget 2025, and not a number more.

Our Budget 2025 coverage is thanks to The Spinoff Members. The Spinoff is not backed by billion-dollar budgets or billionaires, we’re backed by you. To meet our current goal, we need 500 new members by the end of June. Please donate now.

This morning, journalists were ushered into the Beehive’s banquet hall, and connected to a closed wifi network that only allowed access to one website. On that website were the budget documents, which were then handed out as enormous stacks by Treasury staff. Later, the journos were treated to a lunchtime buffet including ham and mustard sammies.

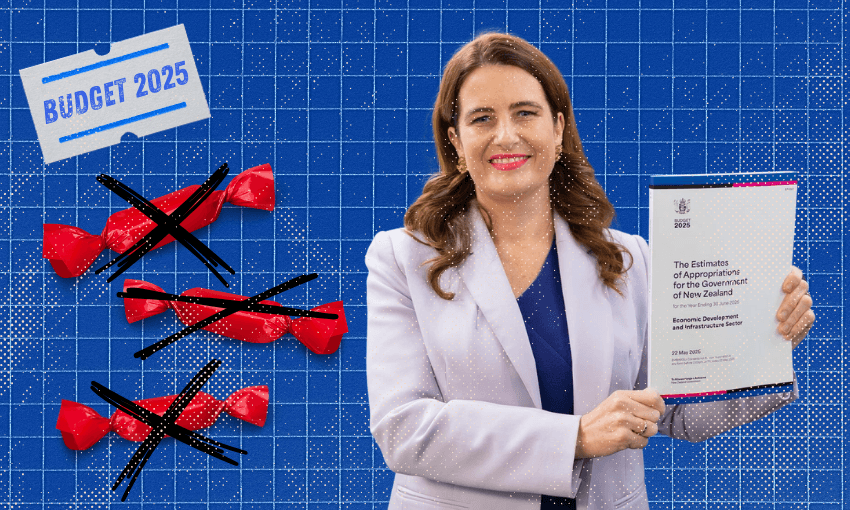

At 2pm, the embargo lifted, every media outlet scurried to publish summaries of the stacks (including us) and finance minister Nicola Willis stood up in parliament to present her work and say that “every Kiwi knows this government has their back” before being slammed by the opposition, which is simply tradition on budget day.

What’s all this hooha for then?

The budget reveals how the government plans to spend all of its money for the next 12 months. Most of that money comes from tax – whether that be from paycheques, GST or company tax. Things like ACC levies, the emissions trading revenue and fines contribute too.

How much money are we talking about?

There are two big numbers within the budget. The operating allowance (sometimes called opex) and the capital allowance (sometimes called capex). The operating allowance is new money to spend on ongoing costs like public sector wages and infrastructure maintenance. Capital allowance is funding for assets such as infrastructure. If you think about it like running a household, the operating allowance is for bills and groceries, and the capital allowance is for buying a house.

This year’s operating budget is $1.3bn, half of last year’s already small $3.2bn and the tightest in a decade. Some have said that this is not even enough to cover increases in population or inflation. Many, including Chris Hipkins and up to 800 people who protested at parliament grounds today, have said that these savings come at the expense of the 33 cancelled pay equity claims. The changes to the pay equity scheme are forecast to save the government $12.8bn over four years.

The capital allowance has been set at $6.8bn, split mostly across health, education, defence and transport.

Vast volumes of money are unknown to me. Can we start at the vibe of the budget?

The budget’s official title is the Growth Budget, but Willis has also called it “not a lolly scramble”, a “no BS budget” and a “responsible budget”. She’s been careful to highlight that the budget has been put together in “very constrained” circumstances with the “kitty bare” and in “serious overdraft”.

On Monday she said that the most important thing to ensure in this budget is to protect and enhance economic growth with “more investment in the things that make businesses productive.” Though commentators were sceptical in the lead-up that a budget could simultaneously deliver growth and constraint, she’s stuck to the numbers and Pattrick Smellie’s analysis on Business Desk today suggests that the budget’s business-boosting initiative makes sense as a “short-term mood-lifter and a medium-term spur to better commercial and economic performance”.

Why do we have to be so stingy?

Well, workers did get those tax cuts, I mean relief, last July and landlords are back to deducting their full mortgage interest from their rental income. But the top line from the government is about reducing our debt. National has been promising a return to surplus since before the 2023 election, though the timeline has been pushed from 2027 to 2029. On Monday, Willis blamed the previous government for the debt (some of it is Covid recovery related) and said “New Zealand is now running out of credit cards.”

The narrative around debt has been called into question. Toby Moore argues in the Herald that the fears are overblown and misleading. He wrote that Willis has escalated the rhetoric in order to make “otherwise unpopular cuts appear necessary”. Moore warns that in the health system, cutting costs now risks worsening fiscal and workforce pressures they’re expected to face in the future.

Apart from debt, we are still recovering from the economic damage caused by the Covid pandemic and facing global instability.

OK, on to the numbers. What could impact me directly?

KiwiSaver is being revamped. Employers and employees will now be expected to make higher contributions – 3.5% from April 2026 and then 4% from April 2028. In return, from July 1 this year, the government will halve its contribution to 25 cents for every member dollar with a new maximum of $260.72 annually.

Early next year, some medications will be able to be prescribed for up to 12 months rather than three months. Health minister Simeon Brown predicts that this could save patients up to $105 a year in appointment fees and lessen the workload for GPs.

There’s been an increase to Working for Families thresholds and rates which are expected to deliver an extra $14 a fortnight on average to about 142,000 families.

So what’s been cut?

It’s impossible to list them all, but here are a few:

As well as halving the government KiwiSaver contributions to a maximum of $260.72 annually, government contributions will be cut altogether for those earning more than $180,000 a year.

The Best Start child payment scheme will become fully income tested from the first year, with payments cut off when a family earns more than $97,000 a year.

$1.5bn has been cut from the Ministry of Social Development, mostly from emergency housing and a projected reduction in people on the Jobseeker benefit (see below).

Fewer 18 and 19-year-olds will be able to access Jobseeker and emergency benefits as they will now be means tested against their parents’ incomes. The policy is forecast to save the government about $163 million over four years but is not expected to begin until July 2027.

Kāhui Ako, an education scheme that groups schools together to work on common problems, has been cut, returning $375m to the budget.

The Ministry of Health’s baseline funding has dropped by $49m and the Ministry for Pacific Peoples by $35m.

A programme to decarbonise the bus fleet has been cut, saving $56m.

RNZ will lose 7% of its annual funding, saving $18.4m over four years.

What is the proposal for growth, then?

The headline policy is Investment Boost, a tax incentive for businesses to immediately deduct 20% of the cost of new assets – such as tools, machinery, equipment, vehicles and buildings – from taxable income, on top of the existing depreciation write-offs. This is intended to boost productivity. The government predicts this change will increase GDP by 1% and wages by 1.5% over the next 20 years, at a cost of $1.7bn in reduced tax revenue every year.

Over the next four years $200m is being set aside as a contingency for co-investment in new gas fields. Details are yet to come, but the Crown is willing to take commercial stakes of up to 15% in gas field developments for the domestic market.

On Monday a pre-budget announcement revealed that the government is planning to change rules around foreign investment, with the implication that taxing foreign investors less would mean more investment that would “generate growth”. $85 million, over four years, has been designated to a new agency to streamline foreign direct investment in hi-tech sectors.

Anything for retirees?

More SuperGold cardholders will be able to claim back their rates with the eligibility threshold expanding from a household earning of $31,510 to $45,000 and the maximum payout rising to $805. These changes were first pitched in the National-NZ First coalition agreement. There are no changes to superannuation.

Any big announcements in health?

Most of the big health news was announced earlier this week and last week. There is a $447m boost for primary care and urgent after-hours care, $1bn of new capital spending for infrastructure including redeveloping Nelson Hospital, Wellington Emergency Department and upgrading Auckland Hospital, increasing funding for the health and disability commissioner to improve care standards and money for a new multi-agency response to mental health distress calls.

So is the budget good or bad?

Depends who you ask. David Seymour’s post on Facebook this morning said that “the budget represents another year of stable government” and that new policies to promote growth and reduce red tape will mean “we can all be wealthier in the future.”

In parliament, the opposition slammed the budget. Chlöe Swarbrick of the Green Party called it the “trickle-down budget, the no ambition budget, the child poverty budget”.

Labour leader Chris Hipkins said that for many families, “this budget is nothing but bad news”. He said it would be remembered as “the budget that left women out” and started to list the cancelled pay equity claims. Hipkins said that no BS stood for no bold solutions, no bread and shelter and no back-paid settlements.

Meanwhile, Winston Peters stifled a yawn.

For more reactions, see our hot-take roundtable.